All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your hectic life, financial self-reliance can seem like an impossible objective.

Pension, social security, and whatever they would certainly taken care of to conserve. However it's not that easy today. Fewer companies are supplying typical pension and several companies have reduced or discontinued their retirement strategies and your capability to count exclusively on social safety remains in question. Also if benefits haven't been decreased by the time you retire, social security alone was never intended to be adequate to spend for the way of life you desire and are entitled to.

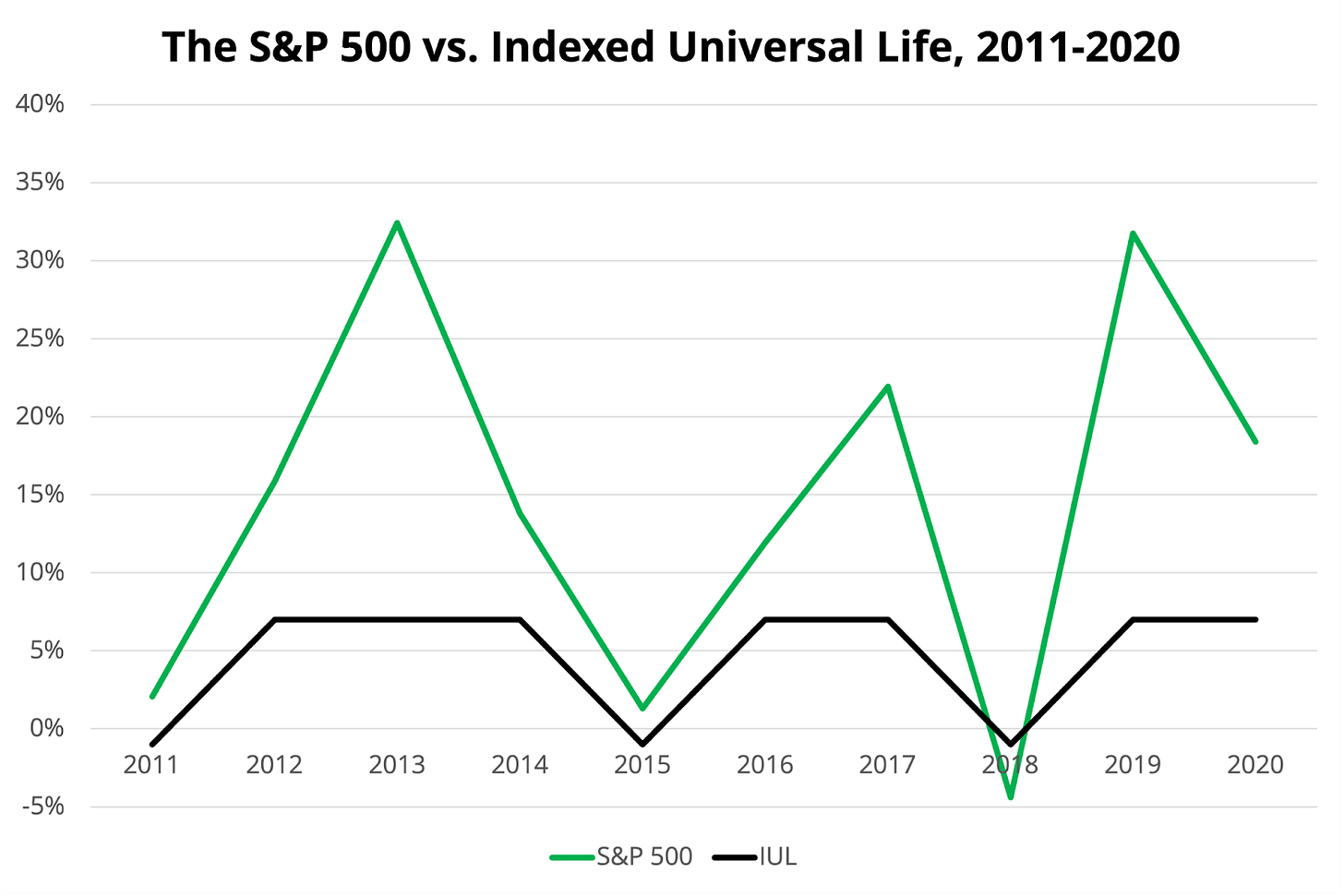

/ wp-end-tag > As component of a sound financial method, an indexed universal life insurance policy can assist

you take on whatever the future brings. Prior to committing to indexed universal life insurance policy, here are some pros and disadvantages to think about. If you pick a great indexed global life insurance policy plan, you may see your money worth grow in worth.

Universal Life Insurance Expires When

Since indexed global life insurance calls for a certain level of risk, insurance companies have a tendency to keep 6. This kind of plan also supplies.

Typically, the insurance policy firm has a vested passion in executing better than the index11. These are all aspects to be thought about when selecting the best type of life insurance coverage for you.

Adjustable Whole Life Insurance

Considering that this kind of plan is a lot more intricate and has a financial investment component, it can usually come with greater costs than various other plans like whole life or term life insurance coverage. If you don't believe indexed universal life insurance policy is appropriate for you, right here are some options to consider: Term life insurance policy is a short-term plan that typically offers coverage for 10 to three decades.

When deciding whether indexed global life insurance policy is ideal for you, it is very important to take into consideration all your options. Whole life insurance policy may be a much better selection if you are seeking even more stability and consistency. On the various other hand, term life insurance policy may be a far better fit if you only need protection for a particular time period. Indexed universal life insurance policy is a sort of policy that provides more control and flexibility, together with greater cash money worth growth potential. While we do not provide indexed universal life insurance coverage, we can supply you with more information concerning entire and term life insurance policies. We recommend discovering all your options and chatting with an Aflac representative to find the most effective suitable for you and your household.

The remainder is included to the cash money worth of the policy after fees are subtracted. While IUL insurance policy might confirm useful to some, it's vital to recognize just how it works prior to acquiring a plan.

Latest Posts

Aseguranza Universal

Equity Indexed Whole Life Insurance

Level Premium Universal Life Insurance